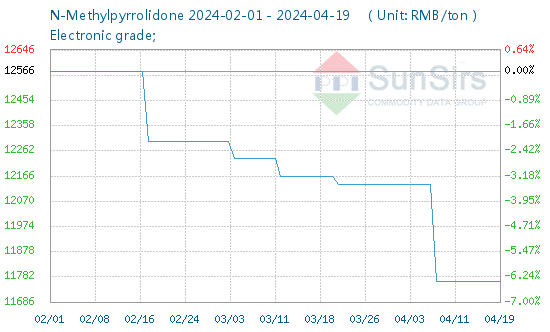

SunSirs: The NMP Market Had Been Operating Steadily This Wee

http://www.chemnet.com

According to the commodity market analysis system of SunSirs, the NMP market haD remained stable this week. On April 15th, the average price of NMP was 11,766 RMB/ton, and on April 19th, the average price of NMP was 11,766 RMB/ton, with>>>